Ichimoku Cloud Trading Strategy: Understanding Market Momentum

Written on July 21, 2025 By admin in Uncategorized

Understanding the Ichimoku Cloud Trading Strategy

The Ichimoku Cloud, also known as Ichimoku Kinko Hyo, is a comprehensive trading strategy widely used by traders to assess market momentum, identify potential reversals, and determine support and resistance levels. Developed by Japanese journalist Goichi Hosoda in the late 1960s, this system provides significantly more data points compared to standard candlestick charts, allowing traders to gain a detailed and holistic view of price action.

The Core Components of Ichimoku Cloud

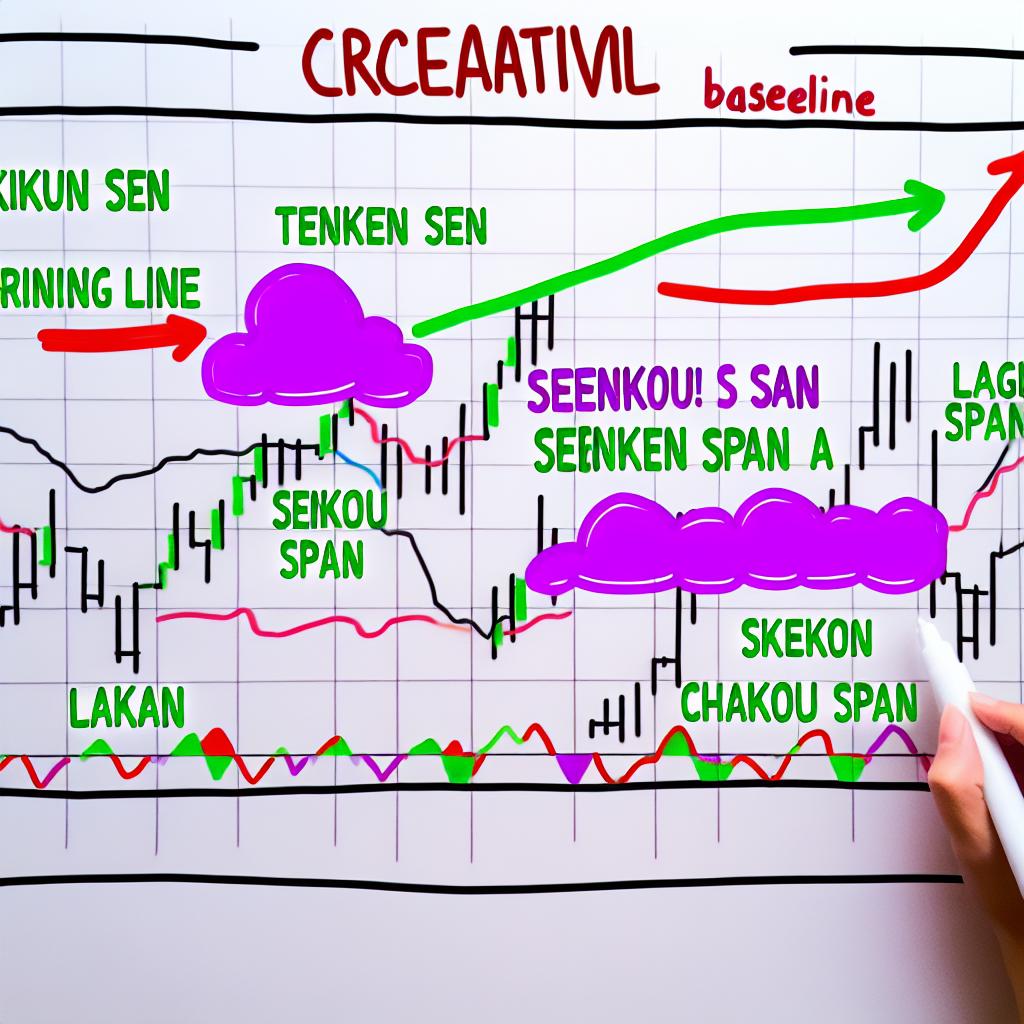

At its foundation, the Ichimoku Cloud is built upon five key components, each contributing unique insights into market trends:

1. Tenkan-sen (Conversion Line): This line is calculated as the average of the highest high and the lowest low over the past nine periods. Its primary function is to represent short-term price movement, acting as a dynamic support or resistance level that traders can monitor closely.

2. Kijun-sen (Base Line): This line is established by averaging the highest high and the lowest low over the past 26 periods. The Kijun-sen is indicative of medium-term trends and is often used by traders to identify possible trend reversals when it crosses with the Tenkan-sen.

3. Senkou Span A (Leading Span A): The calculation for this component involves averaging the Tenkan-sen and the Kijun-sen, with the result plotted 26 periods ahead. This forms the first boundary of the Ichimoku Cloud, which is vital for understanding the overall market sentiment.

4. Senkou Span B (Leading Span B): Determined by averaging the highest high and the lowest low over the last 52 periods, and then plotted 26 periods ahead, Senkou Span B forms the second boundary of the cloud. Together, Senkou Span A and Senkou Span B create the *Kumo,* or cloud, which is a critical aspect of this trading strategy.

5. Chikou Span (Lagging Span): The Chikou Span plots the closing price 26 days back on the chart. This backward plotting provides traders with a visual representation of price momentum, aiding them in understanding movement direction.

Market Momentum with the Cloud

The cloud itself, known as the *Kumo,* is a major element that analysts and traders scrutinize. When the price is positioned above the cloud, it typically signifies a bullish trend, indicating that the asset is likely to continue rising. Conversely, when the price is below the cloud, it often reflects a bearish situation, suggesting downward pressure on the asset. Furthermore, if the cloud is rising or widening, it can indicate increasing momentum in the prevailing direction, whether bullish or bearish.

Signal Interpretation

Signals generated by the Ichimoku strategy are generally categorized into bullish and bearish signals. Understanding these signals is crucial for making informed trading decisions.

Bullish Signals: These positive indicators occur in several scenarios, such as when the Tenkan-sen crosses above the Kijun-sen, when the asset’s price moves above the cloud, or when Senkou Span A is positioned above Senkou Span B. Each of these situations suggests a potential rise in market prices, offering traders insight into favourable trading opportunities.

Bearish Signals: On the opposite end, bearish signals manifest when the Tenkan-sen crosses below the Kijun-sen, when the price falls beneath the cloud, or when Senkou Span A is below Senkou Span B. These conditions suggest a potential decline in market prices, warning traders to be cautious or take protective measures.

Utilizing Ichimoku in Trading

Incorporating the Ichimoku Cloud strategy into trading practices requires a combination of experience and a solid understanding of its dynamics. The complexity of the system can be initially overwhelming, but thorough practice enhances a trader’s ability to utilize it effectively. Generally, traders often pair the Ichimoku Cloud with other technical analysis tools to confirm signals, thereby reducing the risk of false alerts and making more informed decisions.

For traders seeking to deepen their knowledge and expertise in using the Ichimoku Cloud strategy, many online platforms offer educational courses and resources. Engaging with trading education websites can provide further insights and illustrative examples, offering traders the opportunity to practice and refine this technique effectively. By leveraging these resources, traders can develop a more profound understanding and enhance their proficiency with the Ichimoku trading strategy.

This strategy, with its roots in historical trading practices, continues to offer relevant and insightful guidance to modern traders. Its design allows for real-time analysis, making it invaluable in today’s fast-paced trading environments. Consequently, understanding and mastering the Ichimoku Cloud not only aids in identifying market trends but also equips traders with a strategic advantage, ensuring they remain adaptive and responsive to market changes.

This article was last updated on: July 21, 2025